AML/KYC Data for Identity Verification

Identity Verification (IDV) is increasingly the first formal interaction users have with a business, sometimes even before providing their credit card number. This process is extremely difficult because the user expects it to be quick and frictionless, while the government expects it to be a thorough check that meets legal requirements, including Knowing Your Customer (KYC) rules. This becomes the first compliance check point for a business, and integrating watchlist checks into this step is crucial. After all, someone can have a valid ID, but still be on a terrorist watchlist.

The good news is that during the ID verification process, an IDV provider is already extracting the critical information needed needed to establish a clear record of KYC and compliance.

Clients of IDV companies (banks, FinTECHs, insurers and others) increasingly want to minimize their compliance integrations and the question is no longer are you buying an IDV service and a watchlist service, but are you buying a watchlist service with IDV or an IDV service with watchlist data.

Integrating with Castellum.AI helps IDV companies not only prevent contract loss, but also to expand their offering and grow their total market share.

How Castellum.AI Adds Value to Your IDV Process

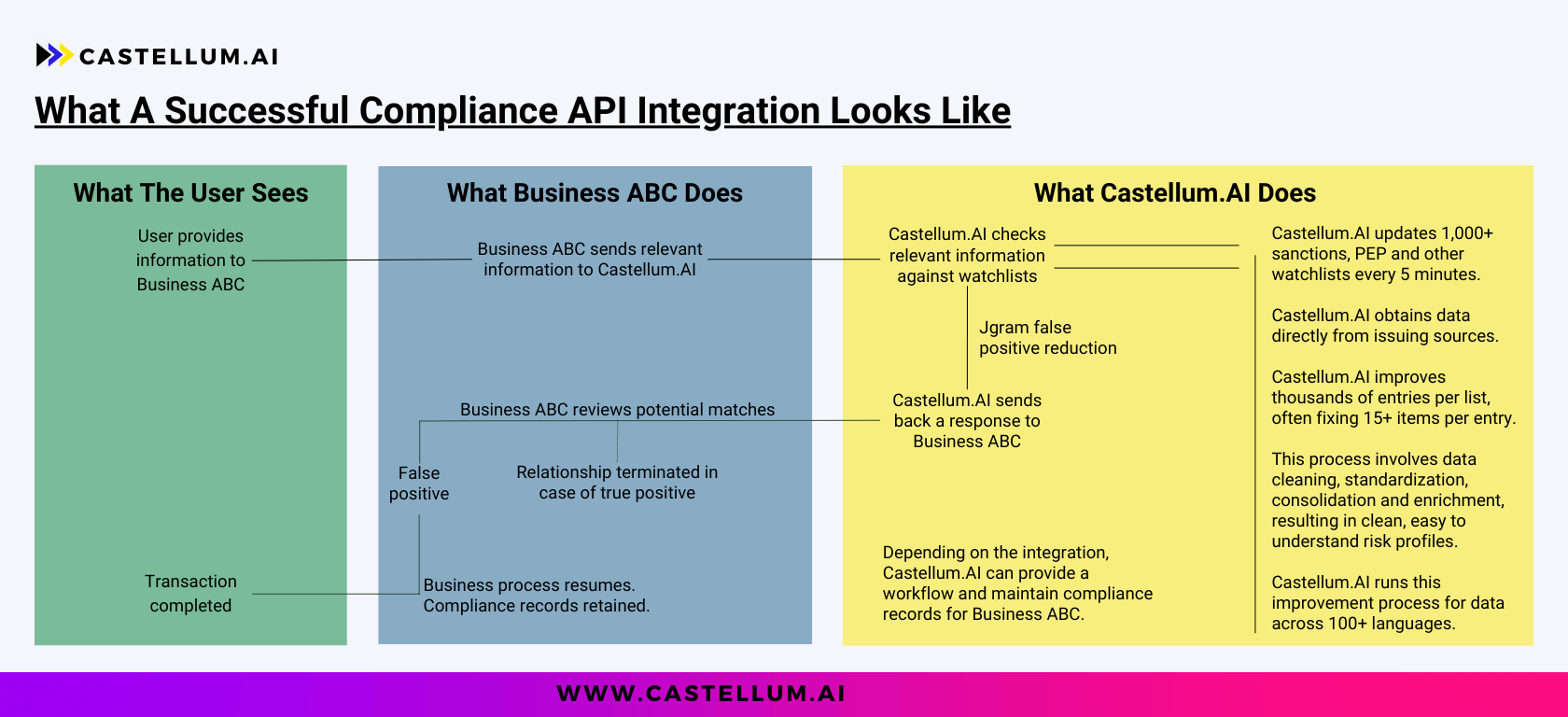

While the checks may look simple externally, Castellum.AI goes through a rigorous process to ensure that verified IDs are not linked to high-risk individuals.

Castellum.AI checks global watchlists every five minutes. Once an update is detected (data addition, data deletion or data modification) the new data set is ingested directly from the issuing authority (US Treasury, Japan Ministry of Foreign Affairs, Qatar’s National Counter Terrorism Committee, etc…).

Castellum.AI improves thousands of entries per list, often fixing 15+ items per entry. This process involves data cleaning, standardization, consolidation and enrichment, resulting in clean, easy to understand risk profiles. Castellum.AI runs this improvement process for data across 100+ languages.

Castellum.AI automatically reduces false positives through its proprietary search, matching and scoring algorithm, Jgram, which breaks down search terms in a series of ngram tokens. This allows for significantly more accurate results than legacy algorithms like Soundex, Jarowinkler and Levenshtein.

How To Integrate With Castellum.AI

Our clients report that on average integrating with Castellum.AI takes about one software engineer one week. For IDV companies, this process is straightforward because in the IDV process, you are already extracting names, ID#s and other items which can be directly mapped against the same fields within Castellum.AI data schema.

The speed with which Castellum.AI responds, the accuracy of our results, the low volume of false positives and the pre-implementation testing that Castellum.AI conducts means that you can estimate the likely workload (and cost savings) before integration, for both you and your clients. Below is a graphic of the process.

Learn more about integrating today

About Castellum.AI

Castellum.AI automates compliance screening by providing watchlist screening solutions across an online platform, API, and bulk data.

Castellum.AI obtains global sanctions information directly from authorities issuing sanctions, and then proceeds to standardize, clean and enrich the data, extracting key information like IDs and addresses from text blobs. Castellum.AI enriches as many as fifteen separate items per entry.

The database consists of over 1,000 watchlists, covering over 200 countries and eight different categories (sanctions, export control, law enforcement most wanted, contract debarment, politically exposed persons, regulatory enforcement, delisted, and elevated risk). Castellum.AI checks for watchlist updates every five minutes directly from issuing authorities.