AI Agents and Screening

for AML/KYC

Enabling financial institutions to eliminate compliance bottlenecks and speed up business.

94%

Fewer false positives

83%

Less time on L1 alert reviews

5 minute

Data update cycle

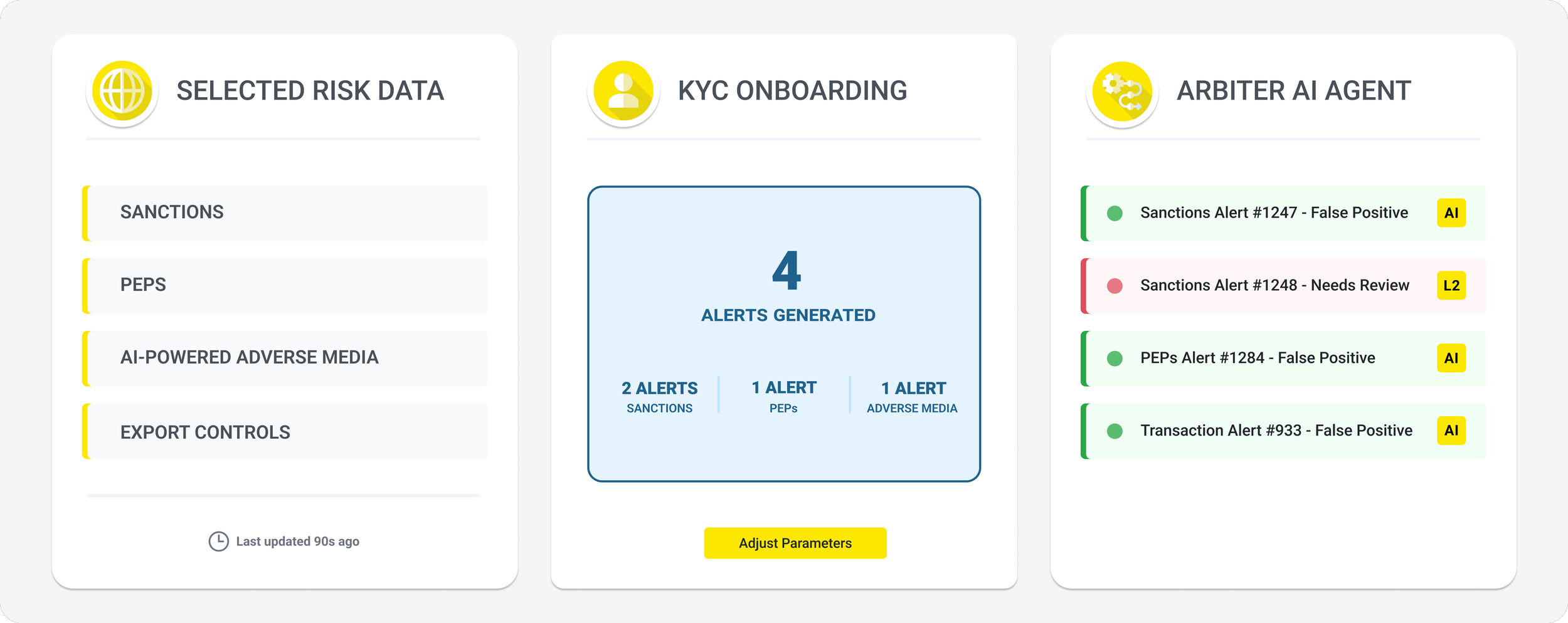

We empower compliance teams to focus on preventing financial crime

Global Data Coverage

Prevent financial crime in real time with our proprietary and enriched data, from 200,000+ sources globally across sanctions, PEPs, adverse media and more.

Real Time AML/KYC Screening

Identify financial crime risk across onboarding, monitoring and transactions, with 94% fewer false positives and never worry about being behind the news.

Explainable AI Agents

Instantly resolve 83% of L1 and L2 alerts. Our explainable, audit-ready, policy-trained AI agents review customer onboarding, pKYC and other types of alerts.

Built for teams in highly-regulated spaces

Why compliance leaders choose Castellum.AI

Modular implementation

Integrate data, screening and AI agents through your core, case management and other systems without disrupting existing workflows.

Audit-ready documentation

Each alert decision is logged with source references and human-readable narratives aligned with your alert review and escalation procedures.

Customizable risk controls

Tailor screening logic, risk thresholds, AI decision-making processes and human intervention points to match your organization’s risk appetite.

Built for highly-regulated workflows

Castellum.AI agents passed a fincrime exam and are trained to align with guidance from the OCC, NCUA, NY DFS, California DFPI and other regulators.

Enterprise-grade scalability

Built to support millions of screenings and AI-assisted decisions daily without compromising speed, accuracy, or oversight.

SOC 2 compliant

Castellum.AI implements enterprise-grade security standards for data processing and supports your existing data transfer protocols.

Eliminate compliance backlogs with AI Agents

Built in-house, our AI agents surface the needle in the haystack so your team can focus on real threats, not false positives.

Resolve L1 and L2 alerts. Agents provide documented, auditable reasoning that auto-escalates to human analysts when additional expertise is needed.

Save time and money. Castellum AI agents use our data - no need to go to other providers, sign more SLAs and worry about latency. It’s all in house.

For your organization only. Agents are trained on your AML/KYC policies and procedures for consistent, accurate and reliable alert adjudication that you can count on.

Your end-to-end compliance solution

Arbiter: AI Agents for FinCrime

Resolve L1 and L2 alerts for onboarding, transaction screening, pKYC and more in less than a second.

Learn more

AI-Powered Adverse Media

Exceptionally reliable results that lead to higher value alerts and faster alert reviews.

Learn more

Transaction Screening

Screen large transaction volumes in real time against global risk data with 94% less false positives.

Learn more

Enriched Sanctions and PEPs data

Detect real threats, not people with similar names —screen 1,000+ watchlists updated every 5 minutes.

Learn more

Real-time Monitoring

Never see the same alert twice and receive instant notice of changes in a customer’s risk profile.

Learn more

Backed by investors representing 100+ banks and credit unions

Ready to get started?

See how we help compliance teams prevent financial crime and save time.