Latest Insights & Articles

The End of the Manual Alert Review Era

AI is ending manual alert review. Learn how financial institutions are moving to real-time, intelligent human-AI risk management.

Stablecoin Compliance with AI: Expert Panel

Practitioner insights on the GENIUS Act, emerging stablecoin crime typologies and why AI has become essential infrastructure for compliance teams navigating BSA requirements.

How Leading Institutions Build AI Agent Workflows in AML/KYC Compliance

Learn from compliance leaders how to design AI agent workflows for AML/KYC programs. Practical insights on governance frameworks, human-AI collaboration, vendor evaluation and implementing AI responsibly while meeting regulatory expectations for explainability and oversight.

Stablecoins and AML: What Compliance Teams Need to Do

The GENIUS Act subjects stablecoins to BSA requirements, creating new AML obligations for financial institutions. Stablecoin compliance includes monitoring cross-chain laundering and sanctions evasion across USDT, USDC networks. Enhanced KYC procedures, blockchain analytics and suspicious activity reporting are now required for stablecoin money laundering detection and compliance programs.

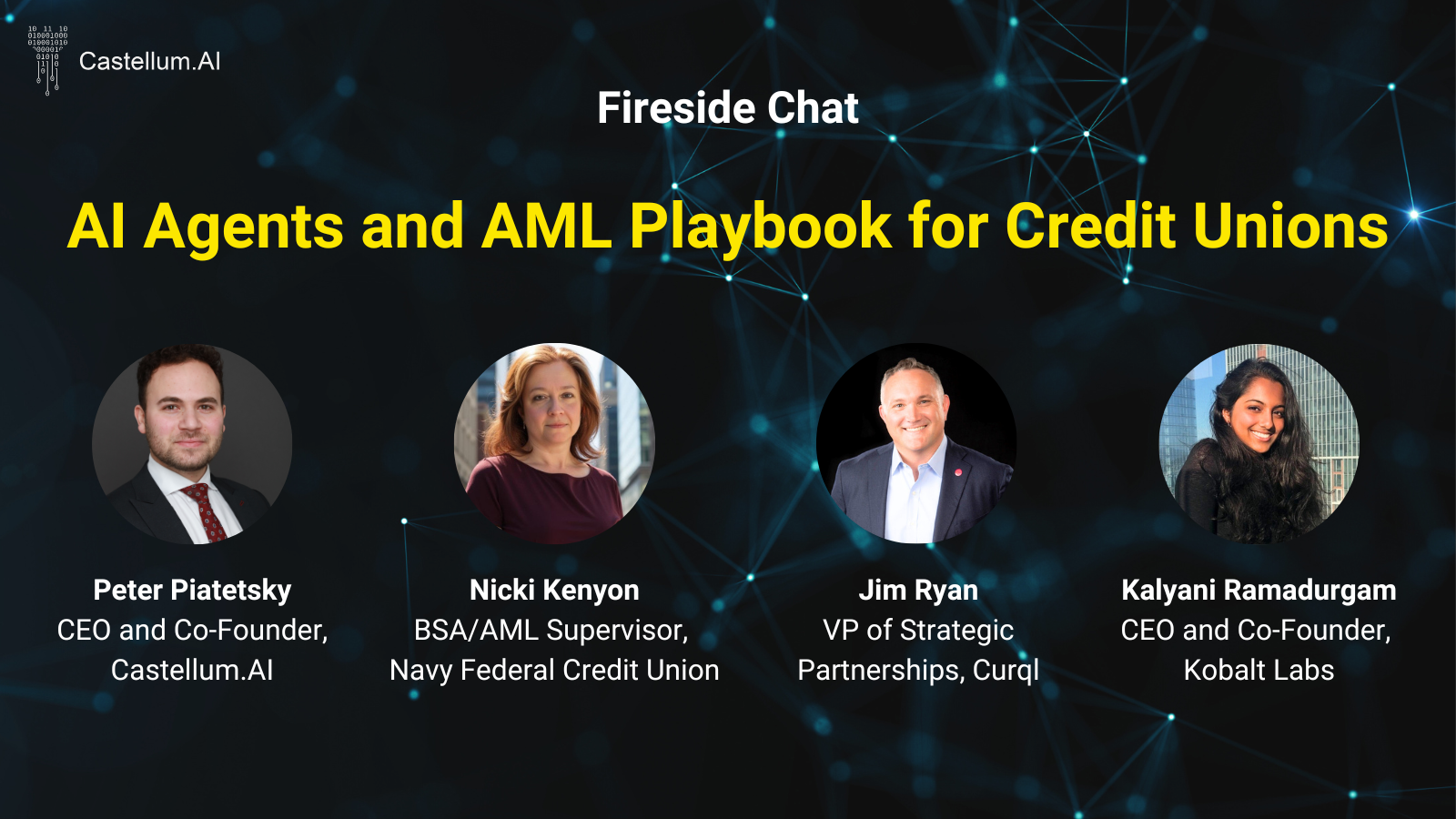

Modernizing AML Compliance in Credit Unions: Expert Panel

Learn from a panel of experts how credit unions can implement AI-powered AML solutions to fight fraud. Actionable insights on regulatory support, human oversight and practical entry points for AI adoption in compliance programs.

Webinar Masterclass: How to Build Best-in-Class AML Testing Programs

AML experts discuss the drawbacks of traditional validation programs, and share a proven framework to build stronger, compliant AML testing programs.

Adverse Media in the Age of AI: Insights from Industry Experts

Industry experts discuss building robust adverse media screening programs with AI capabilities and managing evolving regulatory expectations.

AI Agents in AML/KYC Compliance: Insights from Industry Experts

Industry experts explored the opportunities, risks, and best practices for implementing AI agents in compliance workflows.

Continuous Compliance Testing and How to Benchmark Screening Providers

Industry experts explain the risks of outdated screening systems and how continuous testing, model validation and benchmarking can strengthen sanctions screening.

Sanctions Penetration Testing and Exposing Hidden Risks in Partner Networks

Compliance experts explored the growing risk of hidden sanctions gaps and why independent Sanctions Penetration Testing (SPT) is essential for uncovering vulnerabilities.