KYC Penetration Testing (KPT)

Audit-proof your compliance program to see if high risk actors can bypass control and access your or a partner’s services.

You’re in good company

(with great data)

Identify and protect your organization from gaps in compliance programs.

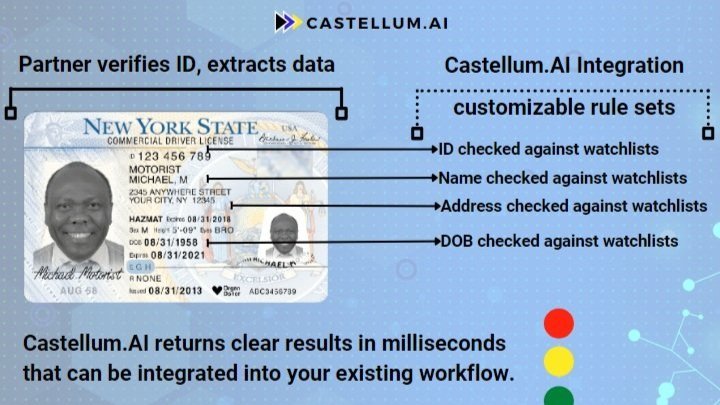

KYC Penetration Testing (KPT) offers effective penetration testing for essential onboarding controls to ensure compliance programs operate in alignment with partners’ policies and procedures.

Automated Reporting

Enable remediation with real-time reporting that provides actionable insights to assess risk severity and remediation options before gaps are identified in regulatory exams.

Scalable Monitoring

Designed for organizations managing large networks, KPT scales to monitor unlimited partners simultaneously.

High-Risk Name Testing

Identify whether partners’ onboarding KYC process enables accounts to be created for parties subject to sanctions, adverse media or other financial crime risk.

IP and Location Testing

Verify whether partners’ compliance infrastructure blocks accounts from sanctioned jurisdictions based on account IP or other geo location markers.

Common FAQs

-

Yes, KYC penetration testing is an add-on that actively tests compliance systems by simulating high-risk scenarios and assessing performance. Unlike regular KYC/sanctions screening which checks entities against various watchlists, KYC penetration testing proactively identifies overall compliance system vulnerabilities—revealing gaps before regulators find them.

-

No, KPT is far more robust! OFAC geo-fencing only targets sanctioned IPs. KPT is a full, automated testing suite that determines whether a KYC process actually protects an organization from sanctioned and high risk individuals and entities, sanctioned IPs, and those using altered or fake business information.

-

KYC Penetration Testing is the right choice when you manage multiple vendors, partners, face heightened regulatory scrutiny, or need proof — not promises — that your compliance safeguards actually work and high-risk actors can’t access your ecosystem. Choose KYC Penetration Testing to discover your partners' compliance gaps before regulators do.

Ready to learn more about KPT?

Looking for a screening solution?

We get it. There’s a lot to consider.

So, we wrote this guide to show your team everything you’ll need to cover during the buying process. Learn to select the right screening system to reduce false positives and meet your CFT/AML compliance needs.