Latest Insights & Articles

Continuous Compliance Testing and How to Benchmark Screening Providers

Industry experts explain the risks of outdated screening systems and how continuous testing, model validation and benchmarking can strengthen sanctions screening.

Sanctions Penetration Testing and Exposing Hidden Risks in Partner Networks

Compliance experts explored the growing risk of hidden sanctions gaps and why independent Sanctions Penetration Testing (SPT) is essential for uncovering vulnerabilities.

A Conversation with Geoff White on Lazarus Group, the ByBit Hack and Money Laundering

Castellum.AI sits down with Geoff White, investigative journalist and author of The Lazarus Heist, to talk about the ByBit heist, North Korean state-sponsored cyber attacks and the future of financial crime in the DeFi space.

Navigating BaaS Compliance Risks in 2025 and Beyond

Compliance experts from sponsor banks, fintechs and RegTech discuss the growing challenges and potential solutions in the Banking-as-a-Services (BaaS) space as we look ahead to 2025.

Managing Bank-Fintech Relationships in BaaS: Key Compliance and Risk Insights

Banking as a Service (BaaS) relationships have been under the regulatory microscope, but how will this change with the incoming Trump Administration? What priorities should sponsor banks set for ensuring their fintech partners have adequate compliance controls? Our latest fireside chat with experts from CFSB, Bates Group and Kobalt labs dive into challenges in bank-fintech relationships.

BaaS is Not in Crisis: Key Insights on Compliance and Risk Management

The Banking as a Service (BaaS) industry isn't in crisis, but it's facing increasing regulatory scrutiny. In the latest "BaaS is Not in Crisis" webinar, compliance experts from Palmera Consulting and FedFis discussed how BaaS players can navigate the evolving landscape, the impact of upcoming regulations, and the importance of automation in maintaining compliance.

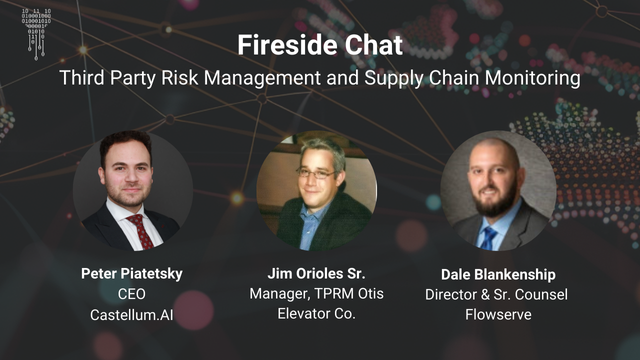

Fireside Chat: TPRM and Supply Chain Monitoring

Real-time monitoring against sanctions, PEPs, adverse media, beneficial ownership and other risk data is critical to ongoing compliance. Ask these five questions to assess whether your monitoring solution provides reliable, real-time risk updates.

BaaS is Not in Crisis: BaaS Banks Less Likely to Be Fined Than Non-BaaS Banks

The Federal Reserve, FDIC and OCC have issued 124 enforcement actions since 2023, but only 22 have focused on BaaS and fines against BaaS banks are smaller and less frequent than those against non-BaaS banks. Learn more about what the data says about the state of embedded finance and practices for preventing an enforcement action.

7 Key Webinar Takeaways on Overcoming a Consent Order

From proactive regulator relationships to leveraging third-party expertise, these 7 key takeaways can strengthen your compliance program.