Want to be ahead of the headlines?

How To Use Shell and Shelf Companies to Launder Money

Shelf companies are an increasingly popular means for money launderers to hide the origin of funds and avoid scrutiny. But what exactly are shelf companies, and how can compliance teams address this risk?

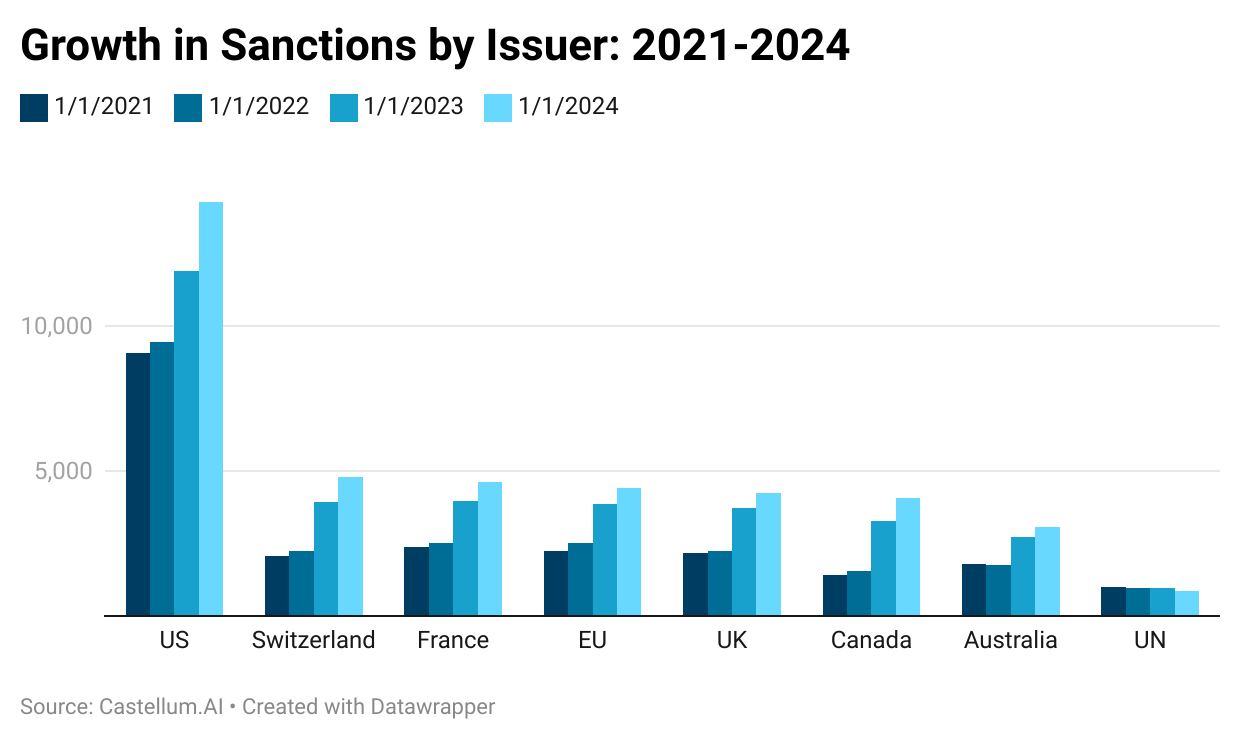

Year in Review: How Sanctions Changed in 2023 with 17 charts

2023 was another historic year in sanctions activity after 2022 saw the largest number of targeted sanctions adopted on record. Russia solidified its position as the most sanctioned country globally as a result of its 2022 invasion of Ukraine, but the number of sanctions levied in response to Hamas’ October attack was limited. Meanwhile, countries like Iran, Belarus and Syria faced continued sanctions pressure.

Corporate Transparency Act Compliance: How to Prepare for FinCEN UBO Reporting

Navigate the 2024 Corporate Transparency Act (CTA) with our guide on FinCEN UBO Reporting.

Best Practices: KYC Onboarding Screening

Discover essential strategies for KYC Onboarding Screening. Ensure your financial services remain compliant and secure with our straightforward, expert guide on customer verification and risk management.

UFLPA Compliance: A Guide for Importers and Supply Chain Companies

The Uyghur Forced Labor Prevention Act (UFLPA) entered into force in June 2022 and places significant restrictions on US imports from China. In addition to a blanket ban on products from Xinjiang, importers must comply with the new UFLPA Entity List banning imports from listed entities, regardless of where goods are manufactured.

Sanction Screening 101: A Comprehensive Guide to Compliance and Best Practices

This comprehensive guide on sanctions screening highlights the importance of organizational compliance with international regulations and best practices for effective screening processes.

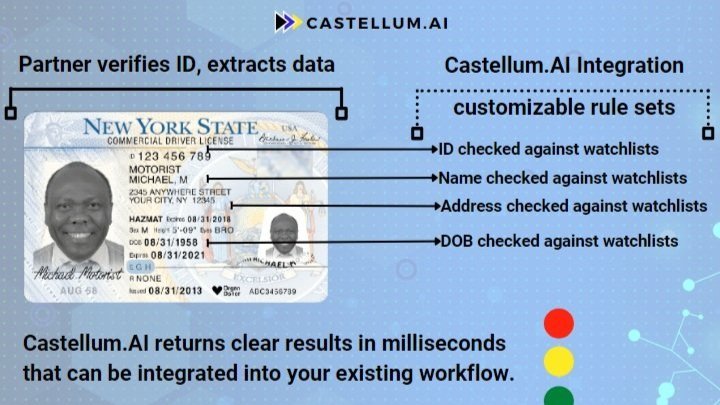

AML/KYC Data for Identity Verification

Identity Verification (IDV) is increasingly the first formal interaction users have with a business, sometimes even before providing their credit card number. This process is extremely difficult because the user expects it to be quick and frictionless, while the government expects it to be thorough and to check a number of legal requirements, including Knowing Your Customer (KYC). This becomes the first compliance check point for a business, and integrating watchlist checks into this step is crucial. After all, someone can have a valid ID, but still be on a terrorist watchlist.

How to Effectively Screen PEPs

Screening your customers and business counterparties to identify PEPs is an important part of a risk-based approach to AML compliance. Doing business with politically exposed persons is not prohibited, but organizations are mandated to identify PEPs and take appropriate measures to reduce money laundering risks.

KYC Screening for Financial Services

Discover the challenges and solutions in KYC screening for financial services. Explore how Castellum.AI enhances reliability, speed, and accuracy in compliance screening, reducing false positives and improving data quality.

Is Your Watchlist Data Any Good? We have a 5 minute test

We created a 5 minute test you can give to any compliance vendor to see if their data is any good. This this test is based on our experience as compliance technology users and purchasers in government and the private sector, as well as technology builders.