Latest Insights & Articles

KYC and AML Fundamentals for Fintechs: 2024 Guide to Navigating Compliance

Fintechs—from crypto exchanges to cross-border remittances providers—face unique challenges to comply with existing Know Your Customer and Anti-Money Laundering (AML) obligations. Read on to understand key regulations impacting fintechs and how to comply with customer onboarding, monitoring and transaction screening requirements.

Best Practices: KYC Onboarding Screening

Discover essential strategies for KYC Onboarding Screening. Ensure your financial services remain compliant and secure with our straightforward, expert guide on customer verification and risk management.

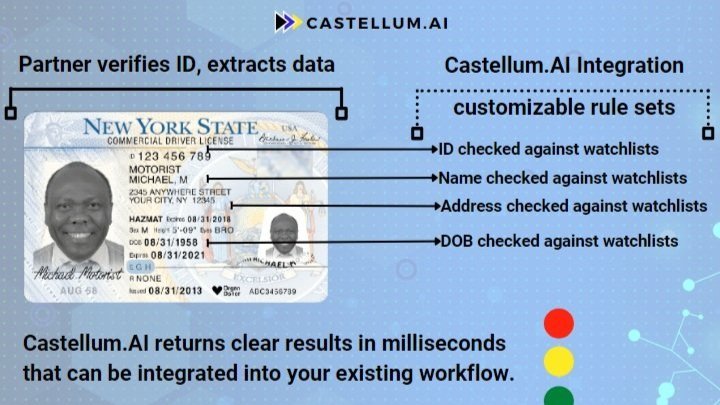

AML/KYC Data for Identity Verification

Identity Verification (IDV) is increasingly the first formal interaction users have with a business, sometimes even before providing their credit card number. This process is extremely difficult because the user expects it to be quick and frictionless, while the government expects it to be thorough and to check a number of legal requirements, including Knowing Your Customer (KYC). This becomes the first compliance check point for a business, and integrating watchlist checks into this step is crucial. After all, someone can have a valid ID, but still be on a terrorist watchlist.