Want to be ahead of the headlines?

Castellum.AI’s Department of Corrections

At Castellum.AI, we're dedicated to ensuring the highest standards of accuracy in compliance data. Our proactive approach and rigorous processes have resulted in significant corrections and improvements across various governmental data sources. These corrections are not just about fixing errors but are pivotal in maintaining the integrity of compliance systems worldwide.

Treasury Influence Map

Treasury officials have unique skills in making economic policy and fighting financial crime, with former U.S. Deputy National Security advisor Juan Zarate calling them “guerillas in grey suits.” In the private sector, ex-Treasury officials leverage their unique skill set, deep financial knowledge, and extensive networks to navigate the complex intersection of government policy and business interests. We wanted to answer the question - where do they that - and for who?

Best Practices: Compliance for Banking as a Service (BaaS)

Regulators have increased scrutiny of BAAS partnerships, raising the need for comprehensive compliance programs across sponsor banks, fintech partners and BAAS middleware providers. Learn more about compliance best practices across BAAS and what to look for in a compliance provider.

KYC and AML Fundamentals for Fintechs: 2024 Guide to Navigating Compliance

Fintechs—from crypto exchanges to cross-border remittances providers—face unique challenges to comply with existing Know Your Customer and Anti-Money Laundering (AML) obligations. Read on to understand key regulations impacting fintechs and how to comply with customer onboarding, monitoring and transaction screening requirements.

How To Use Shell and Shelf Companies to Launder Money

Shelf companies are an increasingly popular means for money launderers to hide the origin of funds and avoid scrutiny. But what exactly are shelf companies, and how can compliance teams address this risk?

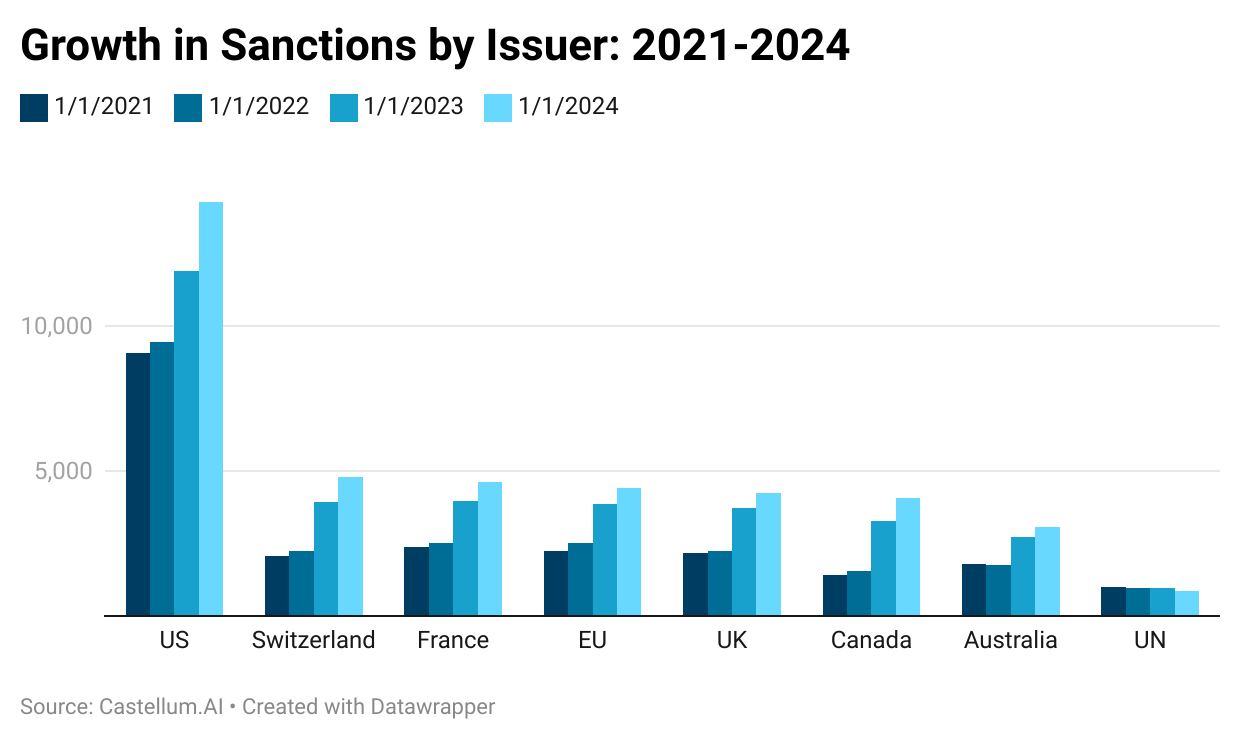

Year in Review: How Sanctions Changed in 2023 with 17 charts

2023 was another historic year in sanctions activity after 2022 saw the largest number of targeted sanctions adopted on record. Russia solidified its position as the most sanctioned country globally as a result of its 2022 invasion of Ukraine, but the number of sanctions levied in response to Hamas’ October attack was limited. Meanwhile, countries like Iran, Belarus and Syria faced continued sanctions pressure.

Corporate Transparency Act Compliance: How to Prepare for FinCEN UBO Reporting

Navigate the 2024 Corporate Transparency Act (CTA) with our guide on FinCEN UBO Reporting.

Best Practices: KYC Onboarding Screening

Discover essential strategies for KYC Onboarding Screening. Ensure your financial services remain compliant and secure with our straightforward, expert guide on customer verification and risk management.

UFLPA Compliance: A Guide for Importers and Supply Chain Companies

The Uyghur Forced Labor Prevention Act (UFLPA) entered into force in June 2022 and places significant restrictions on US imports from China. In addition to a blanket ban on products from Xinjiang, importers must comply with the new UFLPA Entity List banning imports from listed entities, regardless of where goods are manufactured.

Sanction Screening 101: A Comprehensive Guide to Compliance and Best Practices

This comprehensive guide on sanctions screening highlights the importance of organizational compliance with international regulations and best practices for effective screening processes.