Know Your Customer (KYC) Onboarding

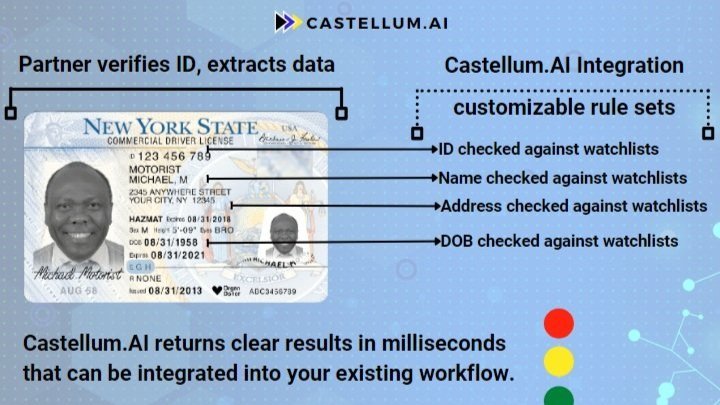

Quickly onboard new clients and partners without friction in a single compliance screen.

you’re in good company

(with great data)

Global Coverage.

Seamlessly integration.

Access comprehensive databases including ultimate beneficial ownership, adverse media, sanctions, PEPs, export controls, and more in days.

-

Automatically enhanced financial crime data to eliminate unnecessary matches.

-

Easily customized filters align screening parameters with your organization's risk profile.

-

Integrated adverse media and custom risk data evaluates new customers and counterparties.

-

1,000+ global risk data lists cover KYC requirements for over 200 countries and territories.

-

Benefit from real-time data synchronization, keeping your KYC processes up-to-date.

-

Utilize our advanced KYC search algorithm JGRAM to enhance accuracy, reduce false positives and provide a streamlined user experience.

88% Fewer

False Positives

Updated Every

5 Minutes

Integrate in Days

Not Months

Ready to get started?

Not quite finished with your research? 🧐

We get it. There’s a lot to consider.

So, we wrote this guide to show your team everything you’ll need to cover during the buying process. Learn to select the right screening system to reduce false positives and meet your CFT/AML compliance needs.